In high school, I spent so much time thinking about how amazing college was going to be that I forgot that leaving home meant entering real life—AKA having to pay for things myself. It’s not that I’d never had a job before—I worked the odd retail job here and there throughout my teens—but when it came to actually managing my finances and monitoring how much I was spending on a daily basis, I was starting from the bottom. And TBH, that’s where I stayed the entire four years of college. It’s not that I went wild or lost control of my money by any means. I spent what I made, and that’s it. But when I graduated, I had approximately zero savings to speak of, which definitely presented a problem when I had to up and move to one of the most expensive cities in the world on a week’s notice.

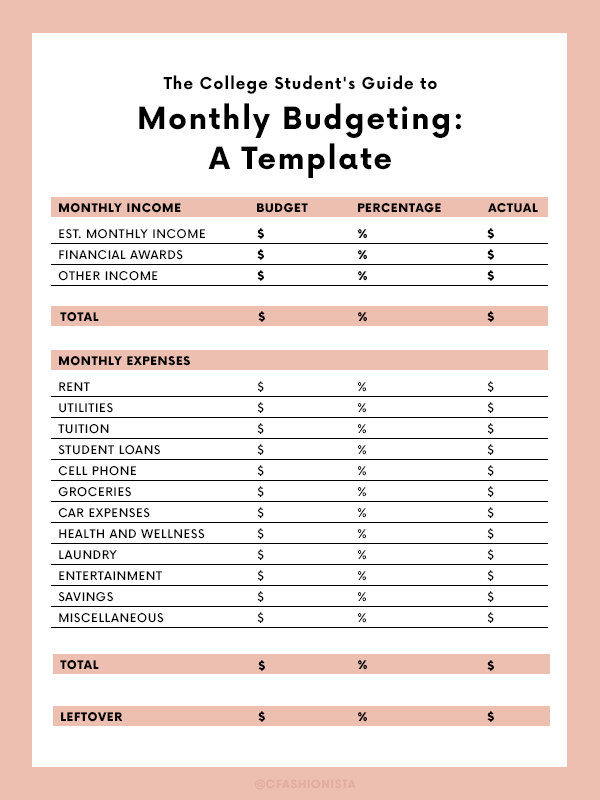

Anyway, what I’m saying is that I wish I had taken the time to take control of my finances before I ventured out into the real world. Not only would it have helped me in college, but it would have taught me early on how to be responsible with my money—a valuable skill that is pretty crucial to have when you graduate. Luckily for you, it’s not as hard as it seems. So quit procrastinating like I did and figure out how to organize your finances today by following this step-by-step guide and using this super simple budget template. Seriously—it’s that easy.

Step 1: Figure Out Your Monthly Income

If you only have one job, this one’s pretty straightforward. Just look at your most recent paycheck and figure out how much you take home each month.

Self-employed and not totally sure how much you make each month? Just divide your earnings for the past year by 12 to get your average monthly income. And if you have multiple jobs? Make sure to add all of your sources of income together each month so you can see all the money that’s coming in. Don’t forget: This should be your income each month after taxes to reflect how much you’re actually taking home.

As a student, you may have other sources of income, like allowance from your parents or financial awards, so remember to account for those as well.

Step 2: List Your Fixed Expenses

According to U.S. News, “Your budget will need to reflect the fixed costs of living for your new lifestyle, including rent or housing payments, utilities, car payments, credit-card payments, and other expenses you don’t expect to change each month.” Any recurring expenses you have each month should be included—these are things that will stay the same for the most part, so you’ll know that you always have to deduct them from your income.

Step 3: Decide How Much You're Going to Save

When figuring out how to organize your finances, savings are a crucial part of your budget. Not sure what amount you should set aside? A common rule is to put away 20% of your paycheck. However, according to MyDomaine, “This category doesn’t consider only what’s directly deposited into a savings account. Paying down existing debt and adding to investments also counts toward this 20%.”

That percentage may not be realistic for you, which is also totally fine. It’s best to lay everything out, see how much you have to spend to live each month, and then decide how much you can put away after you’ve taken care of the necessities.

Step 4: Identify Your Variable Expenses

The Balance defines these types of expenses as things like, “restaurant dining, entertainment, vacations, electronics, and gifts.” To find out how much you’re spending on them, “Review the past year of your credit and debit card statements to calculate your discretionary spending. Add it up and divide by 12 to find a monthly average.”

If you don’t have those kinds of records, make a list of all the things you anticipate spending money on. Do you love to eat out? Are movies your favorite weekend activity? Identify what you think you’ll be spending money on, and play around with numbers to see what you can actually afford each month.

Step 5: Compare Your Expenses to Your Income

To do this, MintLife explains that you should, “Create a spreadsheet and add up how much you spend each month, what you should save for your goals, how much you should put away for retirement and how much debt you owe. If those numbers add up and are less than what you earn, you’re golden.”

However, if they don’t, it’s time to go back to the drawing board. Can you spend less on groceries? Do you need to cut back on your shopping habit? According to MintLife, “The key is to make sure you don’t spend more than you earn and have a little bit extra each month just in case.”

Step 6: Set a Reminder to Check in Every Week

Sure, this all sounds good in theory, but you won’t get anywhere if you’re not consistent with it. MyDomaine states that you should, “Set yourself a calendar reminder on Sunday night and take 15 minutes to review your expenses from the past week. Ask yourself: Where did you exceed budget? Why did that happen? What could you do next week to avoid the same mistake?”

Yes, there may be times when you spend too much and you’re not able to save the amount you’d like to, but it’s okay. The most important part of budgeting is knowing exactly where your money is going at all times so that you’re aware of your financial situation and you can continue to take steps to improve every single day.

Need a little extra help figuring how to organize your finances? Save the budgeting template below to help you get started!

Opening image by Marisa Ganley.